Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

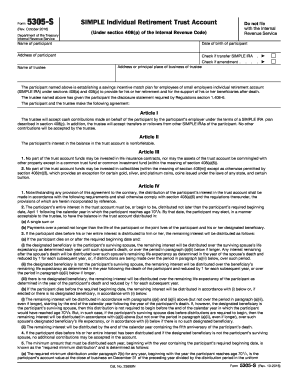

What is how to form 5305?

Form 5305 is a tax form used by employers to establish simplified employee pension (SEP) plans or for employees to establish individual retirement accounts (IRAs). Here are the steps to complete Form 5305:

1. Obtain the form: Visit the official website of the Internal Revenue Service (IRS) and search for Form 5305. You can download the form in PDF format.

2. Identify the purpose: Decide whether you are establishing a SEP plan or an IRA. This will determine the relevant sections of the form that need to be completed.

3. Provide basic information: Fill in your name, address, and other personal details as required by the form.

4. Select the plan type: Indicate whether you are establishing a SEP plan or an IRA by checking the appropriate box on the form.

5. Choose a financial institution: If you are establishing an IRA, specify the financial institution that will serve as the trustee or custodian for the account.

6. Designate a responsible individual: If you are the employer establishing a SEP plan, designate a responsible individual (trustee) for the plan.

7. Complete the applicable sections: Depending on the plan type, fill out the required sections of the form to provide specific details such as contribution limits, plan features, beneficiaries, and investment options.

8. Sign and date: Ensure all necessary signatures are provided and the form is dated by the appropriate individuals.

9. Retain a copy: Make a copy of the completed form for your records before submitting it to the IRS.

10. Submit the form: If you are an employer establishing a SEP plan, provide a copy of the filled form to each eligible employee. If you are establishing an IRA, submit the form to the designated financial institution.

Note: It is always recommended to consult with a tax professional or advisor to ensure compliance and accuracy when completing tax forms. The provided steps serve as a general guide but may vary based on individual circumstances.

Who is required to file how to form 5305?

Form 5305 is used by the employer or plan administrator to establish a SIMPLE (Savings Incentive Match Plan for Employees) IRA plan. Therefore, it is the responsibility of the employer or plan administrator to file Form 5305. The form is typically filed with the IRS, but it does not require the signature of the employer or plan administrator.

How to fill out how to form 5305?

Form 5305 is used to establish a simplified employee pension (SEP) plan. Here is a step-by-step guide on how to fill out IRS Form 5305:

1. Start by entering your personal information at the top of the form, including your name, address, and Social Security number or employer identification number (EIN).

2. In Part I, Section A, indicate whether the plan is being established by an employer or by a self-employed individual. Check the appropriate box.

3. In Part I, Section B, provide the name, address, and EIN (if applicable) of the employer establishing the SEP plan.

4. In Part II, Section A, enter the name, address, and Social Security number of the trustee and custodian responsible for managing the SEP plan.

5. In Part II, Section B, provide details about the financial institution that will serve as the trustee and custodian. Enter their name, address, and EIN (if applicable).

6. In Part III, Section A, enter the start date of the SEP plan. This is usually the same as the tax year in which the plan is established.

7. In Part III, Section B, determine the eligibility requirements for employees to participate in the SEP plan. Indicate the age and length of service requirements (if any) in the designated spaces.

8. In Part IV, Section A, specify the method for calculating the employer contribution. Choose between a percentage of compensation or a uniform percentage of compensation for all eligible employees.

9. In Part IV, Section B, indicate the specific contribution rate. If you choose a uniform percentage, enter the percentage. If you choose a specific percentage, enter both the low and high percentages.

10. In Part V, Section A, provide information about any other retirement plan(s) maintained by the employer. Indicate whether there are any employees participating in another plan or if the SEP plan is the only retirement plan.

11. In Part V, Section B, determine the minimum coverage requirements for the SEP plan. Choose between the gateway percentage or the nondiscrimination plan. Enter the corresponding percentage, if applicable.

12. In Part V, Section C, specify the vesting requirements, if any, for employer contributions.

13. Sign and date the form in Part VI, Section A. If the SEP plan is established by an employer, the authorized representative must sign on behalf of the employer.

14. The trustee or custodian should sign and date the form in Part VI, Section B.

15. Keep a copy of the completed Form 5305 for your records.

It is recommended to consult with a tax professional or financial advisor when completing Form 5305 to ensure accuracy and compliance with applicable tax regulations.

What is the purpose of how to form 5305?

Form 5305 is a document used for establishing an individual retirement account (IRA) for employees. The purpose of Form 5305 is to provide a simplified agreement that enables employers to create a basic IRA plan for their employees. It allows employees to contribute part of their salary to a traditional or Roth IRA, offering them a way to save for retirement with potential tax benefits. The form sets forth the terms and conditions of the IRA, including contribution limits, withdrawal rules, and other guidelines that both the employer and employees must adhere to.

What information must be reported on how to form 5305?

Form 5305, also known as the "Simplified Employee Pension - Individual Retirement Accounts Contribution Agreement," is used by employers to establish a simplified employee pension (SEP) plan. When completing Form 5305, the following information must be reported:

1. Employer information: The name, address, employer identification number (EIN), and other identifying details of the employer establishing the SEP plan.

2. Employee information: The employer should provide the name, address, social security number, and other relevant details of each eligible employee who will participate in the SEP plan.

3. Eligibility requirements: The employer should specify the criteria and conditions for employees to be eligible to participate in the SEP plan, such as minimum age, length of service, or compensation thresholds.

4. Contribution details: The employer must define the contribution percentage or flat dollar amount that will be contributed to the SEP plan on behalf of each eligible employee. This should be clearly stated in the agreement.

5. Vesting information: The employer may include provisions for vesting, which determine when an employee becomes entitled to the SEP plan's contributions. Vesting schedules, if applicable, should be outlined.

6. Administration: The employer should designate a financial institution or trustee responsible for holding and managing the SEP plan's funds. This includes providing the institution's name, address, and contact details.

7. Distribution rules: The agreement should specify the distribution rules for SEP plan assets. This includes outlining the circumstances under which employees may receive distributions, such as retirement, disability, or termination of employment.

8. Communication: The employer is required to inform employees about the establishment of the SEP plan and provide a copy of the completed Form 5305. This ensures compliance and transparency.

It's important to note that while this information provides a general outline of what is required, it is advisable to consult the official IRS instructions for Form 5305 or seek professional assistance when completing the form to ensure accuracy and compliance.

When is the deadline to file how to form 5305 in 2023?

The filing deadline for Form 5305 in 2023 would generally be April 17, 2023. However, it's important to note that deadlines may vary depending on the specific circumstances and possible extensions granted by the IRS. It is always recommended to consult with a tax professional or refer to the official IRS website for the most accurate and up-to-date information regarding tax deadlines.

What is the penalty for the late filing of how to form 5305?

Form 5305 is not specifically related to any filing deadline. However, if you are referring to Form 5305-SEP (Simplified Employee Pension - Individual Retirement Accounts Contribution Agreement), the penalty for late filing can be up to $50 per late return or statement, as stated by the IRS. It's important to note that penalties may vary depending on the specific circumstances and the discretion of the IRS. It is recommended to consult a tax professional or refer to the official IRS guidelines for the most accurate and up-to-date information.

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 5305 s. Open it immediately and start altering it with sophisticated capabilities.

How can I fill out 5305 s simple on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 5305 s iras by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete how to form 5305 s on an Android device?

Use the pdfFiller mobile app and complete your 5305 form printable and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.