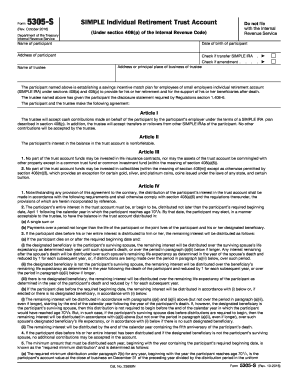

IRS 5305-S 2017-2026 free printable template

Instructions and Help about IRS 5305-S

How to edit IRS 5305-S

How to fill out IRS 5305-S

Latest updates to IRS 5305-S

All You Need to Know About IRS 5305-S

What is IRS 5305-S?

Who needs the form?

Components of the form

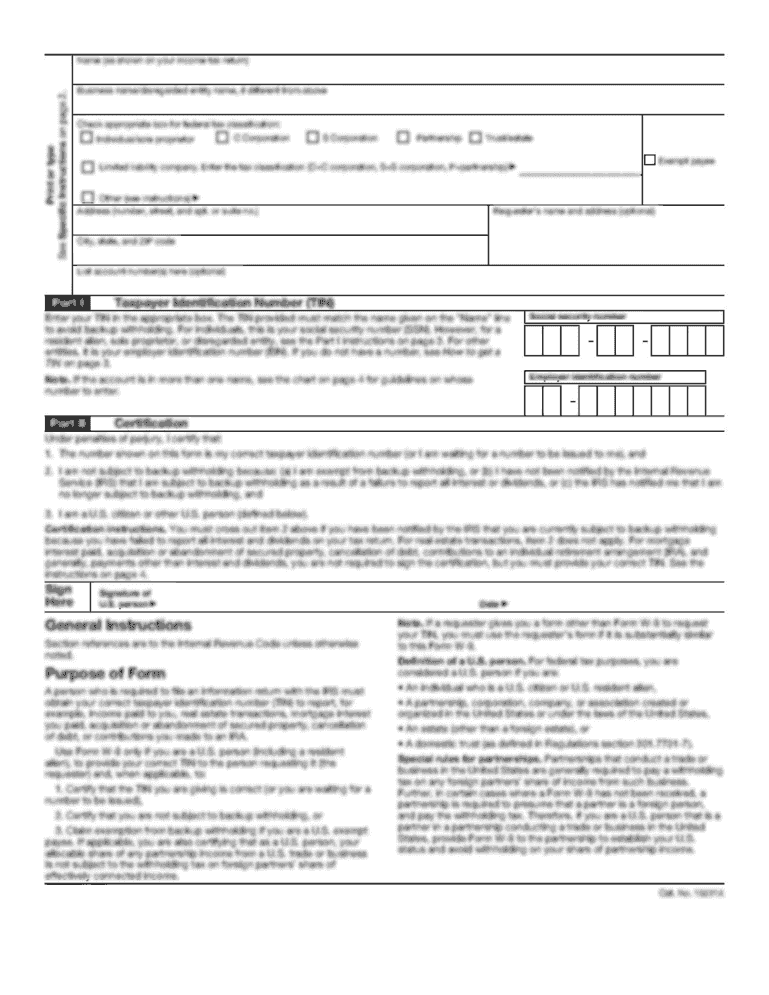

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 5305-S

What should I do if I realize I've made a mistake on my IRS 5305-S after submitting it?

If you discover an error on your submitted IRS 5305-S, you can submit a corrected form or an amendment. It's crucial to act promptly and ensure you follow the appropriate procedures. Proof of corrections, like documentation for changes, may be required, so keep thorough records.

How can I verify if my IRS 5305-S has been received and processed by the IRS?

To check the status of your IRS 5305-S, you can reach out to the IRS directly or utilize their online systems for application tracking if available. Keeping a record of your submission confirmation is helpful in these inquiries.

What are some common errors when submitting the IRS 5305-S, and how can I avoid them?

Common errors with the IRS 5305-S include incorrect taxpayer identification numbers and inaccurate financial information. Double-checking all entries and using software that includes checks for common mistakes can greatly reduce the chances of errors.

Are there any specific requirements I need to meet for e-filing the IRS 5305-S?

When e-filing the IRS 5305-S, ensure you use compatible software that meets IRS guidelines. Additionally, having a secure internet connection and following proper data security practices are essential to protect sensitive information during the filing process.

What should I do if I receive a notice or audit related to my IRS 5305-S?

If you receive a notice or audit concerning your IRS 5305-S, it's vital to read it carefully and understand what the IRS is requesting. Prepare any requested documentation and consider seeking guidance from a tax professional to navigate the response process effectively.